Our Journey, Past and Future

Enabling the Bitcoin On-Chain Economy.

In this article, we first take a look at Bitcoin's historical context, exploring both its successes and remaining challenges, before revealing how Beyond is set to drive the next evolution of the Bitcoin ecosystem. Feel free to skip directly to the Vision section if preferred!

Bitcoin Genesis and Classic Era: 2008-2022

In 2008, a pseudonymous Satoshi Nakamoto introduced Bitcoin to the world: the first and most durable, decentralized blockchain in existence. The network was originally conceived as a peer-to-peer electronic cash system, enabling direct online payments without intermediaries and delivering the world's first digital currency that relied on no central authority.

Over the years, Bitcoin's robust security and resilience—backed by the proof-of-work consensus mechanism—set the stage worldwide for a new era in finance. As adoption grew globally at a remarkable rate, Bitcoin's capabilities were greatly improved in terms of scalability and transaction speed with upgrades like Segregated Witness (2017), the Lightning Network (2018), and Taproot (2021). Nonetheless, despite these advancements and due to technical constraints, Bitcoin could only serve primarily as a medium of exchange and a store of value ("digital gold") until quite recently in 2022.

The Dawn of Inscriptions: 2023

In 2023, the Bitcoin ecosystem embraced a revolutionary concept: inscriptions. This game-changing innovation elevated Bitcoin from merely a store of value (SoV) to a fully functional and programmable financial ecosystem (known as BTCFi), capable of supporting applications across many fields from Decentralized Finance to Real-World Asset tokenization, digital art, and beyond.

By embedding data directly into Bitcoin's transactions, inscriptions have unlocked a new layer of utility on the Bitcoin network itself, in addition to the massively popular $BTC token. This leap forward not only diversifies Bitcoin's use cases but also strengthens its position as a foundational pillar in the broader blockchain space, showcasing its potential to be as versatile and programmable as other modern protocols.

You may wonder, how do these inscriptions work? Imagine you could take a tiny piece of Bitcoin—not just any piece, but a very specific one—and mark it with a digital sticker. These stickers could be anything: a picture, a piece of text, a snippet of a song, or even a small program. This is exactly what inscriptions allow you to do. They let users attach a wide array of digital information directly onto Bitcoin’s smallest units, called satoshis, similar to how you might stick a unique label onto individual pages of a book.

And how do we make sure each of these "book pages" are unique? This is where ordinals come into play. Ordinals are like giving every single satoshi, or book page, a serial number. Just like how every dollar bill has a unique number, every satoshi gets its own identifier, making it distinguishable from all others no matter who they belong to. This numbering system makes it possible to track, trade, and collect any satoshi, especially those with special stickers (inscriptions) attached to them.

Ordinals allow us to identify and track each satoshi, while inscriptions let us attach meaningful data to them. Together, they transform these satoshis from mere fractions of a Bitcoin into unique, programmable digital artifacts. This novel use introduces a whole new dimension to the Bitcoin network, leveraging its security and decentralization to support a flourishing ecosystem without altering Bitcoin’s foundational principles.

Today: Enabling the Bitcoin On-Chain Economy

Looking ahead, Beyond is leading the way into a new paradigm, driving the transition from a classic era of limited utility towards a Bitcoin-powered on-chain global economy.

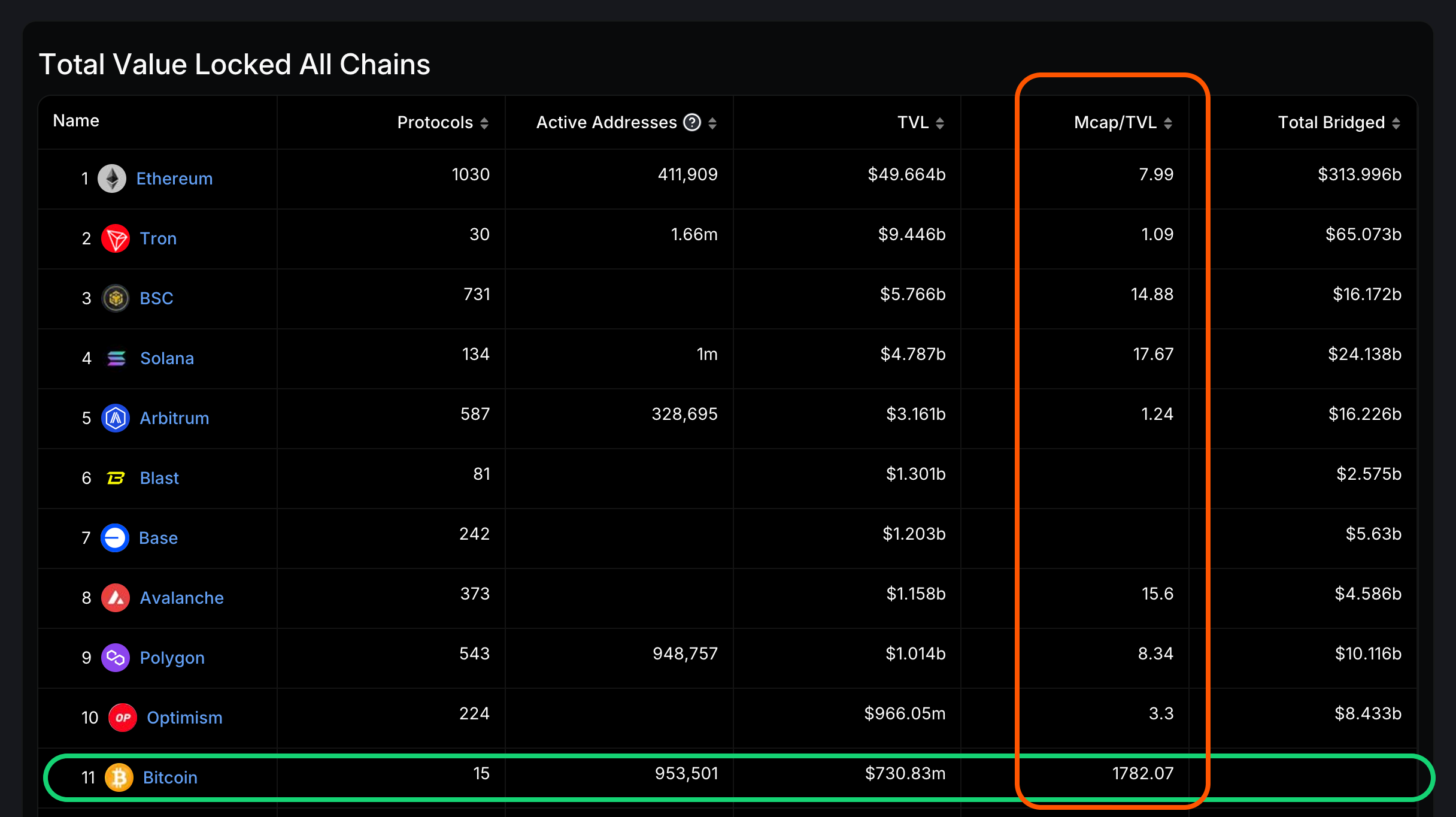

Upon examining the above DefiLlama data, a standout observation is the disproportionate MarketCap/TVL ratio of Bitcoin at ~1780, starkly diverging from the typical range of 1 to 20 (representing up to a x1000 difference in some cases!). This discrepancy highlights a profound imbalance between Bitcoin's market capitalization, which currently exceeds US$1.3 trillion, and its total value locked (TVL), which represents a mere 0.06% of such figure.

The question then arises: What factors contribute to this substantial disparity?

✅ Transaction Costs/Finality

While transaction costs and speed are undoubtedly relevant factors, evidence shows that Ethereum's on-chain economic activity thrives as the leader of the DeFi industry despite not being the fastest nor cheapest blockchain. This indicates that transaction costs and finality times are not significant barriers to growth, as for many use cases they are outweighed by other factors such as security, decentralization, reliability, and network effects.

✅ ✅ Amount of Live Protocols

The examples of Solana, Tron, and Blast, which outperform chains that host significantly more live protocols, suggest that the quality of these protocols and the resources available to them for growth are more crucial than their sheer number. This insight will undeniably impact the expansion of Bitcoin's on-chain activity.

✅ ✅ ✅ Lack of Interoperability

Analyzing the above DefiLlama data, a glaring observation is the absence of Total Bridged Assets in Bitcoin's row, pointing to a present lack of interoperability between the Bitcoin ecosystem and other major blockchain networks. This void represents a critical barrier to growth, emphasizing the urgent need for Bitcoin L1 solutions that facilitate seamless asset bridging and connectivity across the broader digital asset space.

Beyond tackles these historical challenges to mark an inflection point in Bitcoin's history, enabling secure, native L1 on-chain interoperability and achieving:

-

A Fully Interoperable Bitcoin Network: Beyond unifies Bitcoin's various token standards, sidechains, and L2s into a single interoperable, programmable ecosystem—for the first time since the inception of ordinal theory!

-

Catalyzing Asset Inflow: Beyond's interoperability allows US$1.1 trillion in digital assets—incl. US$150 billion in stablecoins—to exist within Bitcoin, the most secure and decentralized blockchain. Also, as these assets enter the ecosystem, the intrinsic value of each satoshi is additionally increased by the its inscription's value.

-

Omnichain Capabilities: Beyond expands the utility of native protocols and tokens by enabling them to leverage omnichain accessibility across the largest protocols (e.g. Aave, Uniswap) and digital assets in the industry, such as $USDT or $SOL.

-

Native BTC Yield Opportunities: Beyond incentivizes the utilization of Bitcoin tokens to generate yield within their own ecosystem, helping initiate a cycle of value creation that can promote user and developer adoption to an unprecedented level in Bitcoin's history.

Within this context, Beyond's vision is clear: to lead Bitcoin's evolution from exclusively a digital store of value to a holistic, global on-chain economy. The beginning of 2024 marked a significant milestone with the introduction of Bitcoin ETF listings and a surge in institutional interest, highlighting Bitcoin's unmatched potential to nurture a decentralized, interoperable, compliant, and robust financial ecosystem. Beyond exists to make this possible.